Who Are the Best Business Insurers in South Africa?

The latest available Customer Satisfaction Index published by Consulta in South Africa helps us understand who the best business insurers in the country are according to the people. These numbers are helpful in choosing your business insurance provider, since you want someone who is likely to pay out claims for bodily injuries, property damage, and loss of business income.

Business insurance policies offer different types of insurance cover, but how customers feel about an insurer can help you decide if they are worth your time. Who keeps their customers happy and gives them the cover they want when it comes to short-term insurance in South Africa? Here are the results:

Top 7 Business Insurance Companies in South Africa

| # | Insurer | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Change |

|---|---|---|---|---|---|---|---|---|

| 1 | OUTsurance | 80.0 | 76.7 | 77.3 | 78.0 | 81.5 | 82.3 | +0.8 |

| 2 | Virseker | 80.7 | 83.2 | 81.7 | -1.5 | |||

| 3 | Old Mutual Insure | 77.5 | 81.2 | 81.3 | +0.1 | |||

| 4 | Momentum | 77.8 | 81.2 | +3.4 | ||||

| Industry average | 76.4 | 77.9 | 75.8 | 76.6 | 80.0 | 79.9 | -0.1 | |

| 5 | Santam | 77.3 | 80.0 | 81.3 | 79.2 | 79.7 | 79.5 | -0.2 |

| 6 | Discovery | 72.3 | 76.2 | 78.8 | +2.2 | |||

| 7 | Auto & General | 76.0 | 74.8 | 78.4 | 75.1 | -3.3 |

Highlights of the Study

1. Strong Competition in the Industry.

The data collected confirms that the business insurance industry in South Africa is highly competitive, with many of the top-scoring brands showing barely a point’s difference in their overall scores. A highly competitive industry benefits the everyday person who needs insurance. each business insurer can also benefit from the high levels of competition, since insurers will go the extra mile to win them as customers.

2. Insurance Overtakes Banking for High SAcsi Scores.

Short-term insurance has, for the first time, outranked banking in South Africa in terms of customer satisfaction. The banking sector usually performs at a higher level, so this increase in SAcsi scores for short-term insurance is a historically significant leap into happier customers.

In 2016, the top-scoring company scored only 80.0, while this year the leader scored 82.3.

Insurers Who Scored Highest in the Survey

1. OUTsurance

For overall customer satisfaction, OUTsurance is leading the charge, with a score of 82.3. This is a great turn of events for the company, whose scores have been steadily rising since 2016 when they scored below the industry average.

2. Virseker

As a relatively new player, Virseker scored very high in 2019, but their scores have dropped, leaving them in second place in the latest Consulta report.

3. Old Mutual Insure

Old Mutual Insure’s scores increased slightly since the previous reporting year, and they placed third overall for customer satisfaction. Their scores are just above the industry average, placing them on par with their peers in performance.

4. Momentum

When it comes to short-term insurance, Momentum’s performance is on par with the industry standards and a mere 0.1 below Old Mutual’s score.

5. Santam

Santam’s scores have been steadily dropping in recent years, leaving them in 5th place overall for customer satisfaction. Although the drops in their scores are only marginal, they are consistent, showing a declining pattern in the satisfaction of their customers with their service, prices, and more.

One could argue that tough market conditions caused the decline. But other insurers who scored in a similar bracket have in contrast been seeing consistent increased scores, such as Old Mutual, OUTsurance, and Momentum. As one of the largest insurers in the country, Santam could do well to address this decline before it becomes material for their bottom line.

6. Discovery

Although placing lower than their competitors, Discovery boasts a rise in their customer satisfaction score that saw them placed sixth overall. Their scores place them below the industry average by a mere 0.2 points, an improvement since 2019.

7. Auto & General

This large South African insurer scored below par, meaning their customer satisfaction scores are below the industry average this year. Even though they have been in the top 7 insurance companies since 2017, their score has dropped significantly.

8. Hollard and Mutual and Federal

These two companies are conspicuously absent from the top-scoring places, having fallen out of the top scorers in 2018 and 2019, respectively.

How Was the Study Conducted?

Consulta surveyed over 2,600 customers who have short-term insurance with the various insurance companies. They conducted this survey as a poll distributed during the second half of 2020 that looked at everything from price to professional service, claim payouts, and more. Their index differentiates between intermediate and direct insurance models.

It’s important to note that both categories compete for the same customers, no matter what their distribution model is. Most types of business insurance fall under the short-term insurance bracket, including commercial property insurance, business liability insurance, cyber liability cover, business interruption insurance, and more. For this reason, the top short-term insurance companies are also considered the top business insurance companies.

If you want to find the right business insurance coverage for your company’s unique needs, there is no need to search through the offerings of different insurers. Instead, fill in the form at the bottom of this page, and the ideal insurance partner will contact you with a business insurance quote.

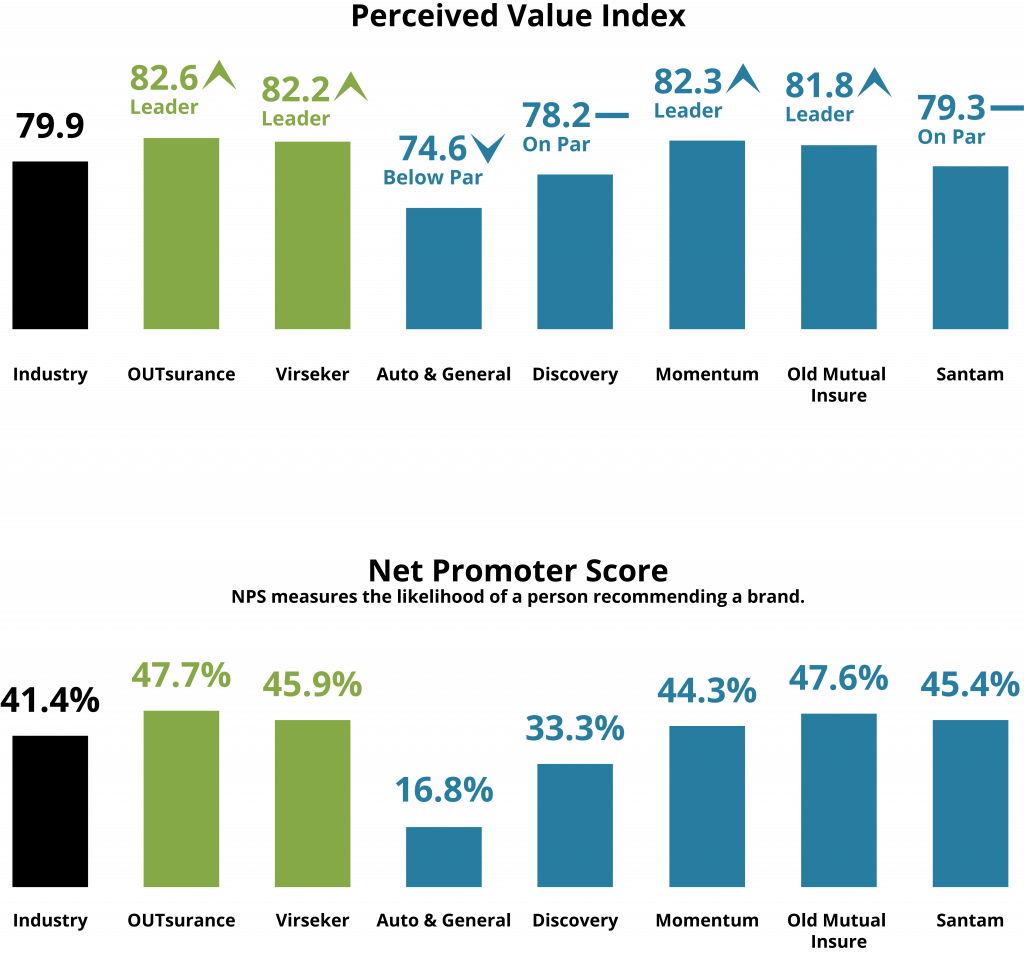

Do Customers Feel They’re Getting Value for Their Money from South African Business Insurers?

During 2020, a marked increase in customer expectations towards each business insurance company occurred. Experts attribute the increase in expectations to an increase in brand messaging during the pandemic and lockdowns, as well as more media attention. Business interruption claims were a hot topic in 2020 and featured in many news stories.

During 2020, a marked increase in customer expectations towards each business insurance company occurred. Experts attribute the increase in expectations to an increase in brand messaging during the pandemic and lockdowns, as well as more media attention. Business interruption claims were a hot topic in 2020 and featured in many news stories.

As businesses struggled with loss of income due to national lockdowns, insurers had to step up to the plate and pay out on business interruption claims or defend their position not to. Guardrisk took a significant media knock, losing a case against a Cape Town restaurant. It forced this insurer to pay out pandemic-related business interruption claims, even though they initially refused.

Some South African business insurers offered their customers payment holidays, premium discounts, partial payouts, and other COVID-19 relief efforts, such as restructuring business client portfolios. As a result, some insurers increased their customer satisfaction scores, while others fell behind.

According to Ineke Prinsloo, the head of customer insights at Consulta, the industry achieved a great deal of goodwill in 2020. At the same time, the very publicly reported refusal to pay business interruption claims and ensuing legal battles left customers questioning whether some insurers could be relied upon to pay out when the time came.

Information published in this article is correct at the time of publication. It is published for informational purposes only and shouldn’t be construed as legal or medical advice.

Sources: Consulta; Businesstech;