COVID-19 lockdowns meant nationwide business shutdowns, but many insurers refused to pay out business interruption claims. But that has changed. Find out how much some of South Africa’s leading insurance companies have paid out for lockdown claims.

How Did the 2020 Lockdowns Affect Local Businesses?

When the COVID-19 pandemic struck it affected communities around the world. In South Africa, the government imposed a nationwide lockdown. This meant small businesses could not remain open, and everyone had to stay home.

Only essential services were allowed to operate, such as medical staff and hospitals. In this environment, small businesses faced unprecedented challenges. The closure of non-essential businesses and the shift to remote work had a devastating impact on many small businesses, with many being forced to shut their doors permanently.

Unable to pay staff or generate income, they were left at the mercy of government assistance and insurance payouts to remain afloat. The amount of business interruption claims flooding the industry no doubt overwhelmed insurers and put their underwriting to challenge.

What Did Insurance Companies in South Africa Initially Say About Paying Out Business-Related Lockdown Claims?

Initially, many insurance companies in South Africa stated that they would not pay out business interruption claims related to the COVID-19 lockdowns, citing that pandemics were not covered under their policies. This caused frustration and disappointment for many small business owners who were already struggling due to the economic impact of the COVID-19 crisis.

However, this stance has since changed for some insurance companies, as they have started to pay out lockdown claims to policyholders after court orders such as the one for Chameleon Café in Cape Town. According to KMPG’s insurance sector report on the year, overall short-term insurance claims rose by R1.9 billion over the year. There were more COVID-related claims, but fewer of other types of claims like vehicle accidents, for example.

This excludes the amount of more than R47 billion paid out for death claims such as funeral and life insurance policy claims within a year of this contagious disease surfacing. This was reported to have been a 43% surge in death-related claims since the COVID-19 outbreak and consequent lockdown period. This would have put pressure on the insurance industry in South Africa.

Which Insurance Companies in South Africa Paid Out, and How Much?

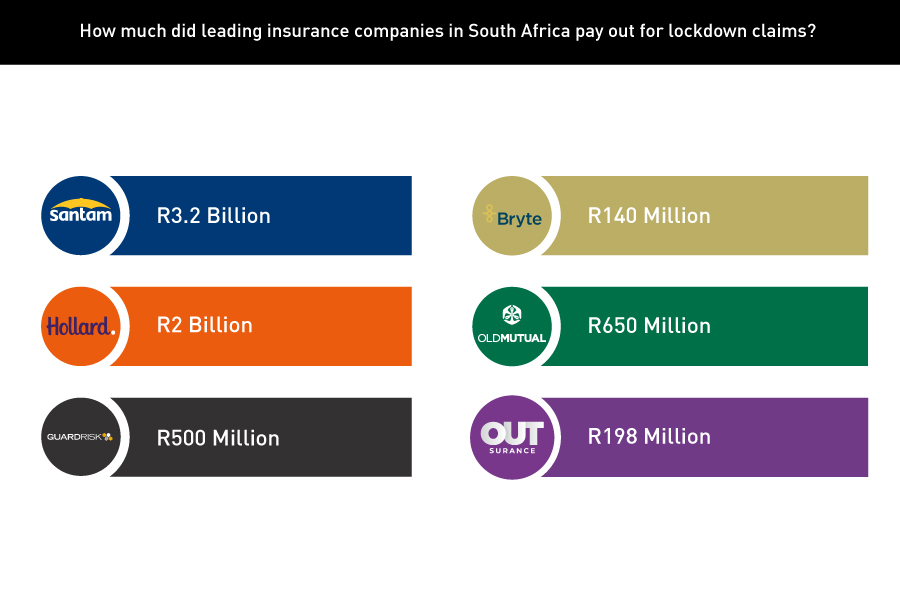

Several insurance companies have reported that they are paying out claims for business interruption and claims for loss of income caused by the lockdowns. The payouts have been made to policyholders in various sectors, including retail, hospitality, and manufacturing. Let’s take a look at what leading insurers have reported they paid out.

Who Are the Leading Insurance Companies in South Africa?

According to KPMG, the leading insurance companies in South Africa based on gross written premiums are Santam, Hollard, and Guardrisk. These leading insurers had the greatest market share in South Africa in 2020 during the COVID-19 pandemic.

How Much did Santam Pay Out for Lockdown Claims?

The CEO of Santam reported that COVID business interruption claims were paid out to the amount of R3.2 billion over an 18-month period by Santam. This included relief payments of R1 billion. The company believes these payouts have provided their policy holders with much-needed relief during an economically challenging time.

How Much did Hollard Pay Out for Lockdown Claims?

In Hollard’s yearly financial report for 2021, the company states that they estimate their total exposure to business interruption claims since the pandemic began is about R2 billion. This includes about R143 million in net outstanding claims provision.

How Much did Guardrisk Pay out for Lockdown Claims?

Guardrisk reported paying out at least 85% of the business interruption claims they received due to the pandemic, which amounted to about R500 million over an 18-month period. They stated that the 15% of claims that had not been paid out were not paid out due to indemnity periods which had expired. The unpaid claims amounted to about R227 million.

Which Other Companies Reported Paying Out Lockdown Claims?

- Old Mutual South Africa has paid over R650 million in business interruption claims related to COVID-19.

- OUTsurance reported setting aside R198 million for lockdown-related business interruption claims, and that all the claims have been settled.

- Telesure insurance holdings reported contributing R320 million to COVID relief effort and R22 million in premium relief. Business interruption claims paid out were not reported by Telesure as a whole, although their brands may have.

- Bryte SA claimed to have paid in excess of R140 million for lockdown claims by the February 2021.

How Do Lockdown Claims Payouts Help Small Business Owners?

How Do Lockdown Claims Payouts Help Small Business Owners?

Despite this positive development of insurers paying out lockdown claims, many small business owners are still struggling to stay afloat, as the economic impact of the pandemic has left their business devastated. The lockdowns have resulted in a significant decline in revenue for many businesses, and many are still struggling to make ends meet or recover from economic losses if they didn’t close down altogether.

It is important to note that the payouts made by insurance companies are not a solution to the economic challenges faced by small businesses, but it can at least help ease the financial burden on some affected business owners.

Where to Get Reliable Business Cover?

You can get insured today for a wide range of risks, from physical damage to a national lockdown today. Your business deserves better insurance that is affordable and reliable. You can get a free quote by filling in the form on this page to get started.

Disclaimer: information is correct at time of publication and is shared for informational purposes only. This article should not be construed as legal, business, or medical advice.

Get Business Insurance Quotes Today

*Based on your profile, your details will be sent to insurance partners that will best serve your needs. That may be a different company than the one featured on this page and form.